Beware of Scamsters while Investing

Investment scams typically occur when fraudsters use deceptive tactics to trick individuals into investing in fraudulent or non-existent opportunities.

Here’s an overview of how investment scams typically unfold, along with precautions to avoid them and steps to take if you fall victim:

- Initial Contact: Scammers may reach out through unsolicited phone calls, emails, social media messages, or online advertisements. They often pose as financial advisors, brokers, or representatives of reputable companies or organizations.

Precautions:

- Be cautious of unsolicited investment offers and maintain a healthy skepticism.

- Independently verify the legitimacy of the person or company contacting you.

- Never make investment decisions solely based on unsolicited communications.

- False Promises: Scammers entice victims with promises of high returns, low risk, or exclusive opportunities that seem too good to be true. They may use persuasive techniques, fake testimonials, and fabricated documentation to create an appearance of legitimacy.

Precautions:

- Be skeptical of investment opportunities that promise guaranteed or unrealistic returns.

- Perform thorough research to understand the investment, associated risks, and historical performance.

- Seek advice from a trusted financial advisor who is not directly affiliated with the opportunity.

- Urgency and Pressure: Scammers create a sense of urgency to prevent victims from conducting due diligence. They may claim that the opportunity is time-limited or that others are already investing.

Precautions:

- Take your time and avoid rushing into investment decisions.

- Beware of high-pressure tactics and emotional manipulation.

- Legitimate investment opportunities allow for careful consideration and due diligence.

- Request for Funds or Information: Once scammers gain victims’ trust, they request funds or personal information. This may involve asking for an initial investment, payment of fees, or sensitive financial and personal details.

Precautions:

- Never provide personal or financial information to unknown or unverified individuals or companies.

- Be cautious of requests for upfront payments or fees before any investment is made.

- Verify the legitimacy of the investment opportunity and the entity requesting funds or information.

- Disappearance or Misuse of Funds: After victims send money or provide personal information, scammers may disappear or continue manipulating them for additional payments. They may misuse funds or use personal information for identity theft.

Precautions:

- Regularly monitor your financial accounts and statements for any unauthorized activity.

- If you suspect fraud, cease communication with the scammer immediately.

- Report the scam to law enforcement agencies and regulatory authorities.

Here are more examples of common scam tactics that individuals should be aware of:

- Pump and Dump Schemes: In a pump and dump scheme, fraudsters artificially inflate the price of a low-volume stock by spreading false or misleading information about the company. Once the price has been pumped up, they sell their shares at the inflated price, causing the price to plummet and leaving other investors with significant losses.

- Offshore Investment Scams: Offshore investment scams often promise high returns while claiming to be outside the jurisdiction of regulatory authorities. These scams typically involve complex structures and obscure locations, making it difficult for investors to recover their money or take legal action if they are defrauded.

- Binary Options and Forex Trading Scams: Binary options and forex trading scams prey on individuals looking to make quick profits in the foreign exchange market. Scammers may promise huge returns or provide false information about their track record and trading strategies. They often use aggressive sales tactics and manipulate trading platforms to ensure that investors lose money.

- Advance Fee Fraud: Advance fee fraud involves scammers asking victims to pay upfront fees or provide personal information in exchange for access to an investment opportunity or a promised windfall. Once the victims pay the fees, the scammers disappear, leaving the victims with losses and no investment.

- Ponzi Schemes: Ponzi schemes promise high returns to investors, usually through investments that are claimed to be highly profitable or low risk. The returns paid to early investors come from the money invested by later investors, rather than from any legitimate business activity. Ponzi schemes eventually collapse when new investors can no longer be found to sustain the payouts.

- Phantom Investments: Scammers may create fictitious investment opportunities, often in non-existent businesses or projects, to lure unsuspecting investors. They may provide fabricated documentation, such as financial statements or contracts, to make the investment seem legitimate. In reality, the money invested is simply stolen by the fraudsters.

- Social Media and Online Scams: Scammers often use social media platforms and online forums to promote fraudulent investment opportunities. They may create fake profiles, post fake testimonials, or use paid influencers to lend credibility to their scams. Always be cautious when considering investment opportunities promoted through social media or online channels.

It’s important to stay vigilant and skeptical when approached with investment opportunities that seem too good to be true or involve high-pressure tactics. Conduct thorough research, seek independent advice, and report suspected scams to protect yourself and others from falling victim to fraudulent schemes.

To avoid falling for investment scams, here are some precautions you can take:

- Conduct Research: Thoroughly research any investment opportunity, including the company, individuals involved, and associated risks. Look for independent sources of information and verify the legitimacy of the investment.

- Be Skeptical: Maintain a healthy skepticism and question investment opportunities that appear too good to be true. Don’t trust claims of guaranteed or unrealistic returns.

- Seek Professional Advice: Consult with a trusted financial advisor or investment professional who is not directly affiliated with the opportunity. They can provide an independent perspective and help you evaluate the risks and merits of the investment.

- Verify Credentials: Check the credentials and licenses of the investment professional or firm. Ensure they are registered with the appropriate regulatory authorities.

- Take Your Time: Avoid rushing into investment decisions. Scammers often use time pressure to prevent victims from conducting proper due diligence.

- Be Wary of Unsolicited Offers: Be cautious of unsolicited investment offers received through cold calls, emails, or social media messages. Legitimate investment opportunities are rarely offered out of the blue.

If you have fallen victim to an investment scam, here are some steps you can take to mitigate the damage and potentially recover:

- Cease Communication: Cut off all communication with the scammer to avoid further losses or manipulation.

- Report the Scam: Report the scam to your local law enforcement authorities and relevant regulatory bodies. Provide them with all relevant information and documentation.

- Contact Financial Institutions: If you have provided your financial information, contact your bank or credit card company immediately to report the fraud and take steps to secure your accounts.

- Seek Legal Advice: Consult with an attorney who specializes in fraud and investment scams. They can guide you on the legal options available to you and help you recover your losses.

- Warn Others: Share your experience with others to raise awareness and prevent them from falling victim to the same scam.

Recovering from an investment scam can be challenging, and the chances of recovering lost funds may vary. It’s important to act quickly, seek professional assistance, and follow the appropriate legal and regulatory channels to increase the likelihood of recovering your funds.

Avoiding investment scams and fraudulent “get rich quick” schemes is crucial, especially for individuals who are new to investing. Here are some essential steps to help protect yourself:

- Educate Yourself: Take the time to learn about investing and financial markets. Understand basic investment concepts, such as risk and return, diversification, and different asset classes. Familiarize yourself with legitimate investment options and strategies.

- Research: Thoroughly research any investment opportunity before committing your money. Investigate the investment, the company or individual offering it, and the associated risks. Look for reviews, news articles, and regulatory filings. Be cautious of high-pressure tactics that try to rush you into making a decision without proper due diligence.

- Verify Credentials and Licenses: Check the credentials and licenses of the investment professional or firm. Many countries have regulatory bodies that oversee financial markets and investments. Ensure that the investment professional is registered with the appropriate regulatory authority.

- Be Skeptical of “Guaranteed” Returns: Be wary of investment opportunities that promise guaranteed or unrealistic returns. Legitimate investments carry a certain degree of risk, and higher returns usually come with higher risks. If an investment sounds too good to be true, it probably is.

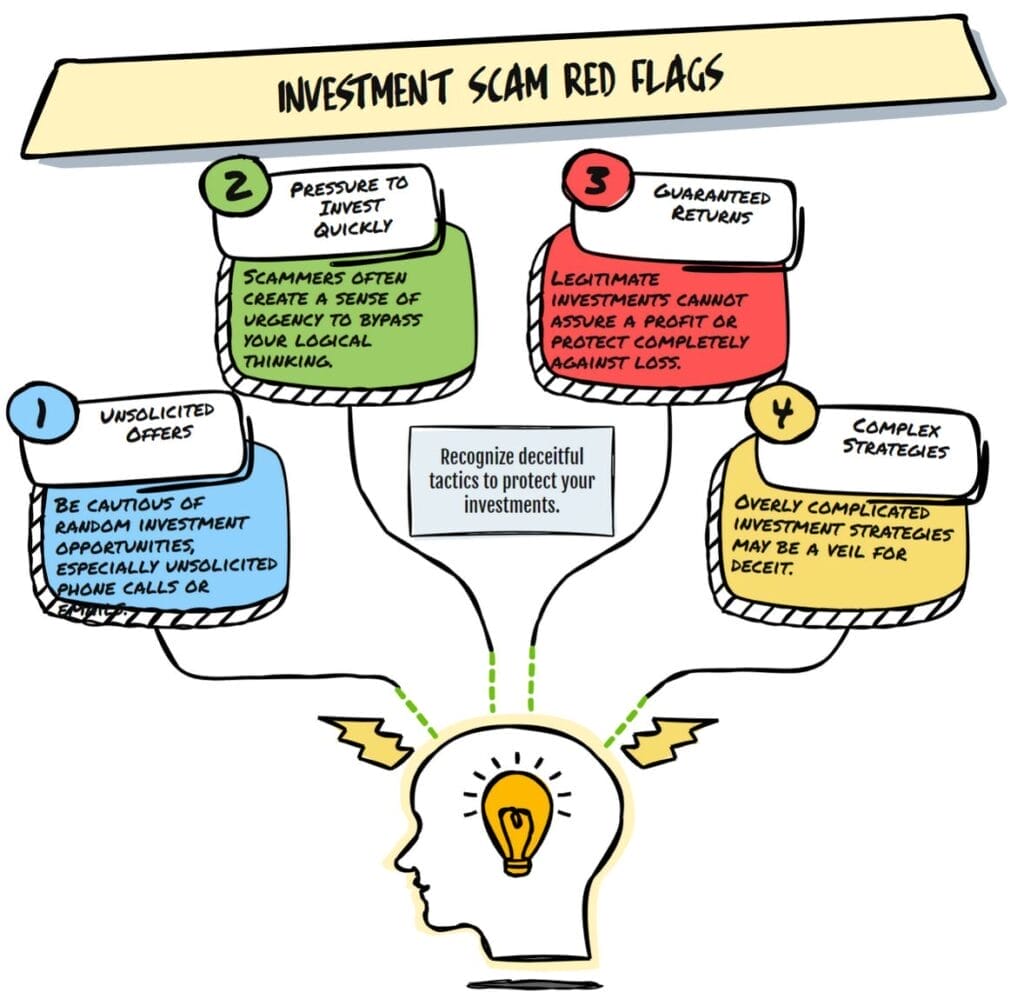

- Watch Out for Red Flags: Look for warning signs that may indicate a potential scam. These may include unsolicited offers, pressure to invest quickly, complex investment structures with limited information, and promises of insider information or exclusive opportunities.

- Understand Common Scam Tactics: Familiarize yourself with common scam tactics to recognize and avoid them. Some examples include Ponzi schemes, pyramid schemes, pump-and-dump schemes, and offshore investment scams. If an investment opportunity relies heavily on recruiting others to join or requires substantial upfront fees, exercise extreme caution.

- Seek Independent Advice: Consult with a trusted financial advisor or seek guidance from knowledgeable individuals who are not directly affiliated with the investment opportunity. An unbiased and independent perspective can help you make informed decisions.

- Diversify Your Investments: Diversification is a key principle of investing. Spread your investments across different asset classes, industries, and geographic regions. By diversifying, you reduce the risk of losing all your money if one investment fails.

- Trust Your Instincts: If something feels off or if you have doubts, trust your instincts and err on the side of caution. It’s better to miss out on an opportunity than to fall victim to a scam.

- Report Suspected Scams: If you come across a suspected investment scam, report it to the appropriate authorities. This helps protect others from falling victim to the same scheme.

Remember, investing should be approached with careful consideration and a long-term perspective. If you’re unsure about an investment, it’s always best to seek advice from professionals or trusted sources before making any decisions.