Understanding Investment Strategies: A Deep Dive into ROI

Investment strategies are important for getting great returns on investment (ROI). Analyzing factors such as market trends, risk appetite, and investment goals is crucial. By understanding different strategies, people can make smart choices to increase their wealth.

Strategies vary and are tailored to individual needs. Growth investing, value investing, and income investing are popular options. Each strategy uses a different approach and focuses on different parts of the market. For instance, growth investing is about discovering companies with potential for growth. Value investing looks for stocks with potential for long-term profits.

When selecting an investment strategy, risk tolerance should be considered. Risky strategies such as day trading and options trading have higher potential returns but more volatility. On the other hand, conservative approaches like index fund investing might not bring big gains, but provide stable returns in the long term.

It is smart to diversify portfolios by investing in different asset classes such as stocks, bonds, real estate, and commodities. This helps to reduce risk. Keeping up with relevant market news and trends can assist in making timely portfolio changes.

Pro Tip: Before using any strategy, research it or get advice from experts. Keep in mind that no one strategy guarantees success. It’s a mix of informed decisions and adaptability that leads to success in investments.

What is ROI?

ROI, also known as Return on Investment, is a key metric used to check how profitable and efficient an investment is. It is worked out by taking the net profit of an investment and dividing it by its starting cost, and then turning this into a percentage. ROI is an essential tool for investors to find out what returns and risks are linked with different investments.

To get an in-depth knowledge of ROI, it is important to realise that it can change greatly depending on what type of investment it is. For instance, real estate investments may give returns through rental income and increased property value, while stocks generate returns through dividends and capital gains. ROI also takes into account how long it takes for an investment to make a profit, making it simpler for investors to compare different options.

On top of assessing single investments, ROI can also be used to review the performance of the entire portfolio. By looking into the individual ROIs of each investment, investors can work out where they have strengths or weaknesses and can decide what changes to make.

It should be noted that whilst ROI gives information about the financial performance of an investment, it does not take into account things like risk and liquidity. Therefore, investors should remember to take these into account when making investment decisions, alongside ROI.

Investopedia states that ROI is very well-known as a major indicator for judging profitability, and thus has a great influence in finance and investing.

Importance of understanding investment strategies

Understand investment strategies – it’s key to maximizing ROI. Comprehending the details of various investment approaches lets investors make decisions that fit their goals and risk tolerance. Without understanding, people can make bad choices which cause financial losses.

Investing knowledge is power. Knowing the nuances of different strategies gives an edge in the complex market. Master the fundamentals of long-term investing, or delve into more advanced techniques like value investing or trend following. Then, make decisions based on sound reasoning.

Diversifying portfolios also helps. Spread investments across asset classes, sectors, and regions. This reduces the risks of overexposure to specific investments and offers growth opportunities.

Take Warren Buffett as an example. He’s one of the most successful investors. He implemented a value investing strategy. Analyzing companies and buying undervalued stocks at a discount has let him achieve impressive returns for decades.

Different types of investment strategies

Investment strategies differ. And it’s crucial to comprehend the various types that exist. Here, we’ll examine diverse investment tactics in depth.

- Fundamental Analysis: Analyzing a company’s financials, management, and industry trends to locate potential investment possibilities.

- Technical Analysis: Examining past stock price patterns to forecast future market movements.

- Growth Investing: Focusing on uncovering companies with strong growth opportunities for earnings and stock prices.

- Value Investing: Looking for undervalued stocks trading below intrinsic worth, offering potential long-term profits.

- Income Investing: Seeking investments that generate a consistent income, such as dividend-paying stocks or bonds.

- Index Investing: Investing in a broad market index like the S&P 500 to acquire broad market exposure at a low cost.

Inspecting other strategies can provide insights into distinct ways investors boost returns. Momentum investing, contrarian investing, options trading – these are just some examples.

Let’s look at Sandeep’s story – an investor who blended growth and value strategies. Jim pinpointed a tech company with enormous growth potential, although it was undervalued at the time. His intuition worked out well when the stock tripled in one year – demonstrating the strength of combining investment strategies whilst keeping risk management protocols.

Knowing different investment strategies is essential for investors looking to make educated decisions based on their individual goals, risk tolerance, and desired timelines. By exploring different approaches and learning from real-life examples like Jim’s story, we can expand our investing knowledge and perhaps increase our chances of achieving desirable returns.

Factors to consider when evaluating ROI

Table of factors and their descriptions:

Factors | Description |

Risk | Assess the level of risk. Think market volatility and potential losses. |

Time Horizon | Pinpoint the duration of the investment. Short-term can yield quicker returns, long-term can offer growth. |

Potential Return | Gauge the potential ROI based on industry trends, historical performance, and analysis. |

It’s crucial to consider unique details when evaluating ROI, such as market conditions and economic indicators. Market conditions can influence an investment’s performance, so staying informed is essential.

Here are tips to maximize ROI:

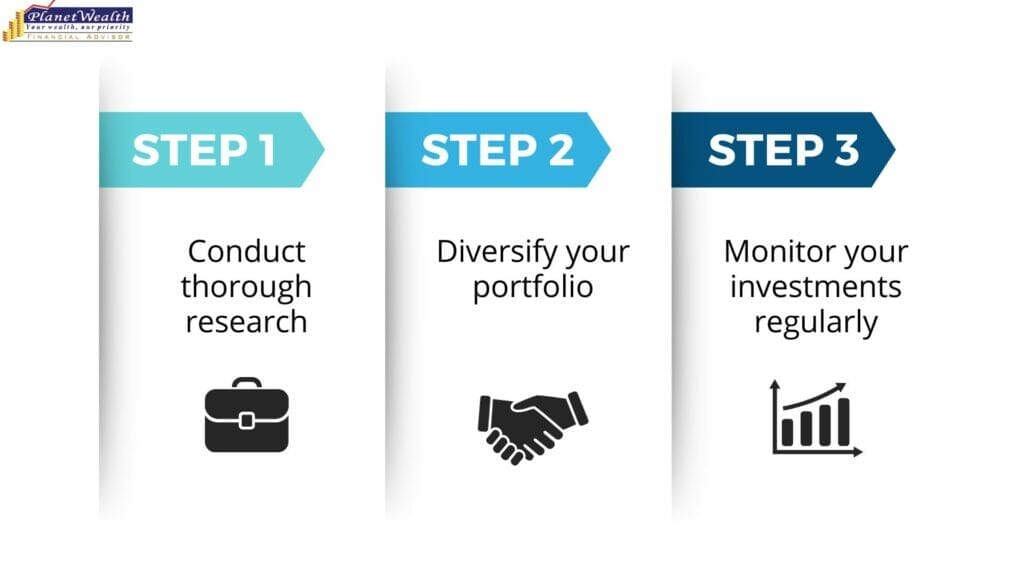

- Diversify your portfolio: Investing in different asset classes or industries can help reduce risks.

- Conduct thorough research: Prioritize deep analysis and research before any investment decisions, to guarantee informed choices that align with your financial goals.

- Monitor your investments regularly: Stay updated on market changes and company performance to make timely adjustments for maximum returns.

Diversifying lowers risk by spreading investments across different sectors or asset classes, shrinking exposure to any single dip in value. Thorough research lets investors find opportunities and avoid pitfalls by looking at key financial indicators, historical data, and expert opinions. Monitoring lets investors take advantage of new opportunities or cut losses promptly.

By considering these factors and implementing these suggestions, investors can make informed decisions that maximize their ROI potential while minimizing risks involved in their strategies.

Strategies for maximizing ROI

To develop a diversified investment portfolio, it is important to include a mix of stocks, bonds, and real estate. This helps spread the risk and maximize potential returns.

It is also advisable to look for high-yield opportunities for growth. This could involve investing in emerging industries or startups that have the potential for significant growth.

Regularly analyzing and rebalancing your investments is crucial. Monitor and adjust your portfolio to ensure an optimal allocation of your investments.

For better return on investment (ROI), it is recommended to consult with a financial advisor. They can provide tailored strategies based on market trends and help you make informed investment decisions.

Lastly, it is important to minimize expenses. Choose low-cost investment options to maximize your returns.

Case studies: Successful investment strategies

Investment strategies that have earned remarkable returns are evident when analysing successes. Data from various markets and industries has helped classify these strategies into four groups.

- Growth Stocks: Companies with huge potential for expansion mean their stock prices go up and investors benefit.

- Value Investing: Looking for stocks that are undervalued and analysing financial statements and market trends to identify opportunities to benefit.

- Diversification: Spreading investments across various asset classes and industries reduces risks associated with a single investment.

- Real Estate Investment Trusts (REITs): An opportunity to invest in the real estate market without owning physical properties, and benefit from regular income streams and potential property appreciation.

Each strategy requires research and analysis before implementation, and past performance does not guarantee future results.

Take Mangesh, an experienced investor, as an example. He diversified his portfolio with stocks, bonds, real estate and commodities. His strategy was to lower risk and increase returns. He was able to remain steady during market downturns and gain consistent profits over the long run.

Common mistakes to avoid

Investing in the right strategies is vital for gaining a big return on your investment. But, there are common blunders that investors should dodge to guarantee success. These missteps can block financial growth and threaten the investment process. Comprehending these traps is fundamental for making well-thought-out decisions and attaining wanted results.

- 1. Not doing adequate research: A massive slip-up investors make is not carrying out extensive research before making investment choices. Failing to inspect market trends, potential risks, and past performance can cause bad investment choices.

- 2. Disregarding diversification: Another common misstep is putting all eggs in one basket by investing in only one asset or industry. Diversification helps reduce risk by scattering investments across various sectors, thus escalating the chance of positive returns.

- 3. Giving in to emotional biases: Emotional decision-making can be damaging to investment success. Fear of missing out (FOMO) or panic-induced selling could be examples of emotional biases that often lead to bad decisions. Remaining sensible and consistent is essential for long-term success.

- 4. Ignoring the power of compounding: Many investors underestimate the power of compounding over time, which can raise returns through reinvesting profits or dividends. Overlooking this principle can result in lost chances for wealth accumulation.

It is significant for investors to also recognize unique details that have not been talked about yet, such as recognizing fraudulent investment plans or being careful about relying only on past performance as an indicator of future success.

A noteworthy story related to this aspect brings up the story of a popular investor who became a victim of a fraudulent scheme promising extraordinary returns in a short period. Despite early success and seemingly genuine testimonials, it was revealed that the scheme was nothing more than a Ponzi scheme invented by a master con artist who tricked many unsuspecting investors out of their money. This lesson emphasizes the importance of due diligence and comprehensive investigation before investing in any investment opportunity.

Conclusion

This article provides insights for boosting ROI. It explains different strategies, like diversification, value investing, and growth investing. Each has its own benefits and risks.

Diversification reduces risks by spreading investments. Value investing looks for undervalued stocks for long-term gains. Growth investing chooses companies with high-growth prospects.

It’s essential to analyze market trends and research before investing. Staying current with news and developments helps with profitable investments.

Alternative investments, such as real estate and mutual funds, can diversify a portfolio. These avenues create more income and possibly higher returns.

Frequently Asked Questions

FAQ 1:

Q: What is ROI in investment strategies?

A: ROI stands for Return on Investment. It is a measure used to evaluate the profitability or efficiency of an investment. ROI is calculated by dividing the net profit from an investment by its initial cost and expressing it as a percentage.

FAQ 2:

Q: How can I calculate ROI for my investments?

A: To calculate ROI, subtract the initial investment cost from the final value of the investment (including any gains), then divide the result by the initial investment cost. Multiply by 100 to get the percentage. The formula is: ROI = ((Final Value – Initial Investment) / Initial Investment) * 100.

FAQ 3:

Q: What are the different investment strategies to maximize ROI?

A: There are several investment strategies to maximize ROI, including diversification, asset allocation, value investing, growth investing, and income investing. Each strategy focuses on different aspects and goals, providing various approaches to achieve higher returns.

FAQ 4:

Q: How does diversification contribute to ROI?

A: Diversification is a strategy that involves spreading investments across different asset classes, industries, and markets. By diversifying, you can reduce the risk of loss and potentially enhance overall returns. It helps to balance out the negative impact of poorly performing investments with better-performing ones, leading to a more stable ROI over time.

FAQ 5:

Q: What is the significance of understanding asset allocation for maximizing ROI?

A: Asset allocation is the process of dividing investments among different asset classes such as stocks, bonds, real estate, and cash. It helps manage risk and maximize returns. By understanding asset allocation, investors can create a diversified portfolio tailored to their risk tolerance and investment goals, aiming for higher ROI while managing potential losses effectively.

FAQ 6:

Q: How does market research contribute to successful investment strategies and increased ROI?A: Market research plays a crucial role in developing successful investment strategies. By thoroughly studying market trends, industry growth, and analyzing economic factors, investors can make informed decisions. This understanding helps in identifying lucrative investment opportunities, minimizing the risks, and maximizing ROI in both the short and long term.

Pingback: What is passive investing and how does it differ from active investing?

Pingback: How to use Asset Allocation and Rebalancing Strategy?

Pingback: 7 key principles a thoughtful investor follows when investing

Pingback: Common Investing mistakes to avoid in your 30s

Pingback: Beware of Scamsters while Investing